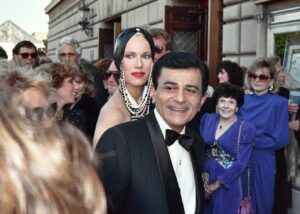

A Family Meltdown: Retirement Lessons Learned from Casey Kasem

The heartbreaking end-of-life story of legendary broadcaster Casey Kasem serves as a stark warning for anyone seeking retirement planning success.

Will your plan for retirement lead to disaster if your health fails? Will you end up forced into institutional care, go broke paying for care, or become a burden on your family?

For millions of Americans, the answer is yes. This video explains why retirement turns into a nightmare for so many people and how completing this course can keep these nightmares from happening to you.

Save $4 when you buy the Master Your Future Bundle. Includes the first edition of the Master Your Future LifePlanning Workbook, which offers step-by-step guidance to create your LifePlan for retirement, and the Master Your Future Program DVD, the groundbreaking public television special that offers a stark lesson in the dismal state of retirement planning in America--and what to do about it.

Create your LifePlan for retirement in a live online classroom setting led by elder law attorney Rajiv Nagaich or another experienced LifePlanner. Includes five two-hour sessions, plus access to AgingOptions Academy, a one-year membership to AgingOptions Portal, a Master Your Future LifePlanning Workbook, a one-on-one session to review your LifePlan Blueprint, and access to exclusive offers on legal documents, facilitated family meetings, and more.

Since the AgingOptions Radio Show first began airing in the Pacific Northwest in 2006, elder law attorney Rajiv Nagaich has been helping people answer some of life’s toughest questions. In this comprehensive anthology, drawn from thousands of hours of AgingOptions Radio Show broadcasts, listen to Rajiv Nagaich answer callers’ questions about retirement planning. His answers are packed with important nuggets of information that will help you create your own LifePlan for retirement. It’s a recording you’ll want to listen to again and again.

Elder law attorney Rajiv Nagaich is known as much for his riveting presentation style as he is for his sage advice. Audiences everywhere love hearing Rajivisms, those bursts of powerful retirement planning wisdom delivered with unexpected wit that often make you laugh out loud. This DVD collection of Rajivisms is loaded with actionable advice you can use right now to make your retirement plan better.

As an elder law attorney, Rajiv Nagaich has spent more than two decades helping older adults and their family caregivers cope with retirement plan failure. Despite doing exactly what their trusted advisors had told them to do—enrolling in Medicare, saving plenty of money, buying long-term care insurance, and creating an estate plan—Rajiv's clients found themselves forced into institutional care, assets lost to unplanned care costs, and a burden to their families. In Your Retirement: Dream or Disaster, you will learn the shocking truth about why this happens—and what you can do to avoid it. This book is a must read if you want to avoid the hidden traps in retirement planning advice that turn life into a living nightmare for 70% of Americans.

What does it take to avoid the nursing home, avoid going broke and avoid burdening your family during your retirement years? That’s the question elder law attorney Rajiv Nagaich answers in Master Your Future, the groundbreaking program that has aired more than 1,500 times on public television stations nationwide. The Master Your Future Program DVD is a great a way to watch (and rewatch) Rajiv’s shocking revelations and piercing insights about the state of retirement planning in America. Drawing on his own family’s experience and that of thousands of clients during his 20+ years as an elder law attorney, Rajiv explains why traditional approaches fall short and shows how this failure results in 70% of American retirees being forced into institutional care. Rajiv then offers a surprisingly simple solution to create the retirement of your dreams.

The Master Your Future LifePlanning Workbook guides you through the process of planning for your later years so you can live out your years with more confidence. Examine your readiness for retirement, get practical solutions to threats and challenges that come with aging, and follow a step-by-step action plan to build a LifePlan Blueprint that will deliver secure, predictable outcomes. The Master Your Future LifePlanning Workbook includes 200 pages of exceptional content, detailed information that helps you weigh your options, decision worksheets to create your personal Blueprint, and guidance for selecting and working with professional advisors.