The New Year is well underway, and hopefully you’re starting 2024 on a note of optimism. But for too many seniors, all the burdens of 2023 have come rushing into the new year in the form of medical debt.

If medical debt isn’t a problem for you, you may not give it a second thought, but it is a debilitating financial reality for millions of U.S. seniors, as we read this week in this article from NextAvenue written by freelance reporter Lucy Lazarony.

“You’ve got your health back after a medical problem and are feeling fine,” Lazarony writes. “Now it is time to tackle those medical bills.” The good news, she states, is that you may be able to negotiate the amount you owe. “But,” she adds, [you must] act quickly to avoid having to deal with a collection agency.” Once the debt goes to collection, you’re at the mercy of demanding letters and harassing phone calls that never seem to let up.

One key goal is to keep your debt from being sent to collection, something most organizations will avoid if they believe that you intend to pay at least a portion of what’s owed. Lazarony offers some helpful steps to take and suggests common mistakes to avoid. Before we dive in, however, we wondered how widespread a problem medical debt actually is.

Medical Debt Affects Millions, Especially Those Most Vulnerable

In researching this article, we checked out current data from the National Council on Aging which provides some sobering perspective. According to the agency, roughly 4 million Americans 65 and older have unpaid medical bills. About 1 in 10 are actually in debt due to medical expenses – but among the lowest-income seniors, that figure is closer to 1 in 5. That means they’re unable to stay current with what they owe.

The pressure can be devastating. “A study in the Journal of General Internal Medicine revealed that out-of-pocket medical expenditures in the five years prior to a person’s death totaled more than $38,000, leaving 1 in 4 seniors approaching bankruptcy,” says the NCOA.

The NextAvenue report offers these step-by-step recommendations in dealing with medical debt.

To Reduce Medical Debt, Start with a Realistic Budget

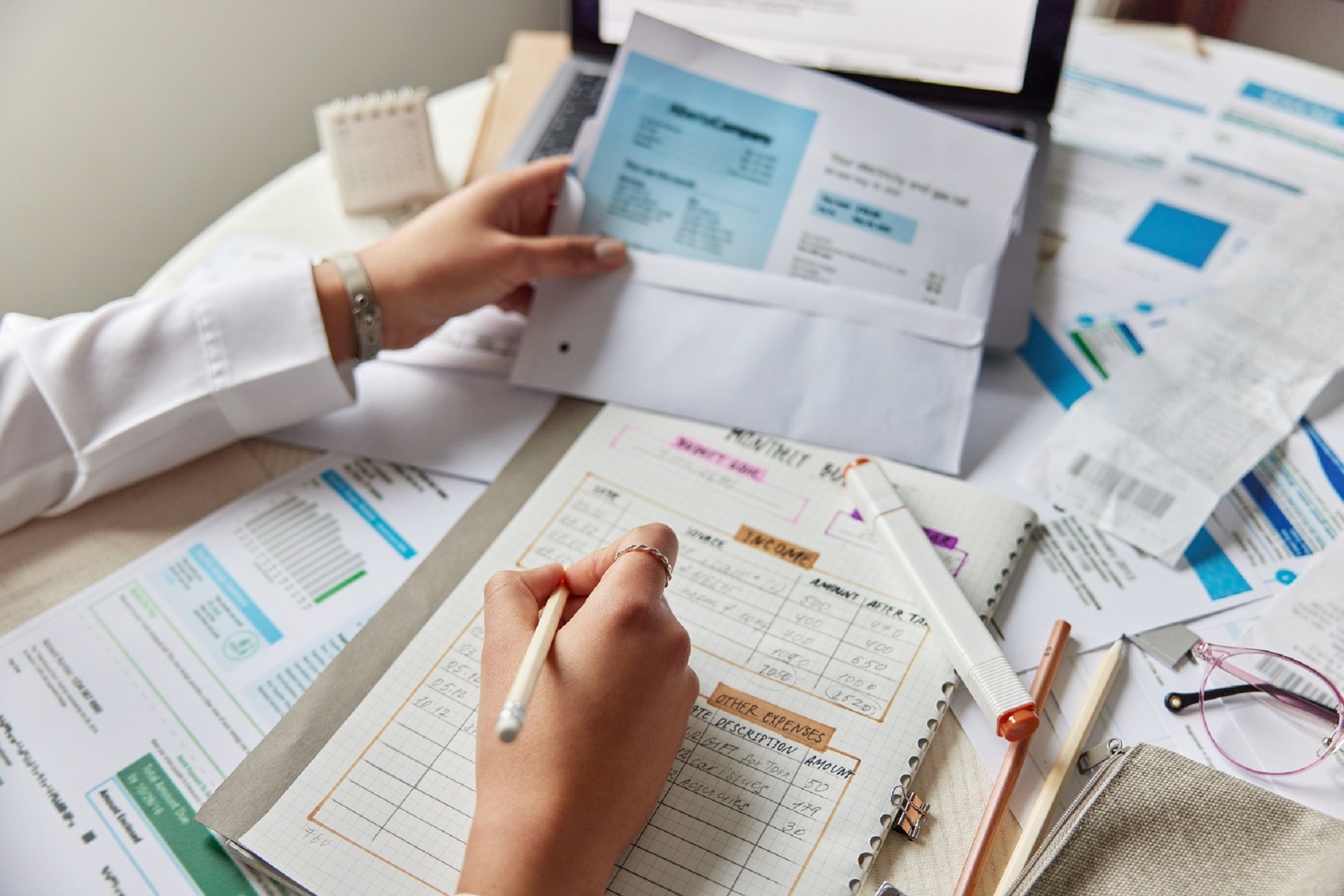

Writing in NextAvenue, Lazarony says it’s important to get your bearings before sending any payments. “Before you pay a single bill, take a close look at your financial situation,” she writes. “Find the time to dig into your budget.” You have to know your starting point.

Lazarony spoke with Pennsylvania financial planner Jason Weckerly who echoed that advice. “If you haven’t already done so, create a budget of income and expenses,” he advises. “The budget should include all sources of income and differentiate between essential and discretionary expenses. This step is critical.”

Budgeting also has a strong emotional benefit. “Moreover, from a psychological perspective, this exercise can help to make one feel more empowered and less overwhelmed by the debt,” Weckerly adds.

Address Medical Debt Proactively by Contacting the Creditor

Carrying debt can cause us to retreat and self-isolate, imagining that the problem will vanish if we ignore it. But this is the exact wrong thing to do.

“Don’t wait to discuss your medical debt with a creditor,” Lazarony emphasizes. “You don’t know when a doctor or hospital will send your bill to a collection agency” – which, as we stated above, is the one thing you most want to avoid.

As financial planner Weckerly puts it, “Ignoring the debt until you can afford to make a payment . . . is a common mistake.” Make the call early on and start the dialogue.

Discuss Medical Debt with an Actual Human Being

When calling big institutions such as hospitals or insurance companies, we’ve all experienced the teeth-grinding frustration of feeling lost in an endless phone tree of useless or confusing options. But keep at it, says Lazarony, and persevere.

“Be determined and patient in pushing your way through a creditor’s automated phone tree system,” she urges, “until you get to speak with an actual person.” Then once you finally reach a human, ask the following questions:

Payment Plans: Are payment plans available?

Minimum Payments: If so, what is the minimum amount the doctor or hospital would accept on a monthly or quarterly basis?

Missed Payments: If a payment is missed, what is the typical grace period before your office sends the debt to collections?

Added Fees: Are there any fees associated with a payment plan option?

Revisit Your Budget – and Include Your Spouse

Now it’s time to go back to the budget and sharpen your pencil, Weckerly tells Lazarony.

“Return to the budget and take an honest inventory of what expenses labeled ‘discretionary’ can be sacrificed to meet the monthly debt obligation,” says Weckerly. “If married, be sure to include your partner in the conversation. Not including one’s partner is a common mistake.”

That’s because, in some states, medical debt can become joint debt, shared with your spouse. Indeed, Washington State is among those states where medical debts obligate both spouses.

As Weckerly explains, “I’ve dealt with many clients in the past who are married but ‘plan separately.’ Realize that any debt acquired during marriage is typically treated as joint debt, depending on state law. Include them in the conversation wherever possible.”

When Dealing with Medical Bills, Don’t be Afraid to Negotiate

The old adage is, “You’ll seldom receive what you don’t ask for.” Don’t let pride get in the way of asking for a debt reduction. “Offer quicker payment if the doctor or hospital will agree to a lower amount,” Lazarony urges.

“Doctors and health care providers are often willing to negotiate on the amount of debt owed,” financial author Lynnette Khalfani-Cox told NextAvenue. “They would rather receive partial payment than no payment at all, and therefore are open to discussing lower lump-sum payments or interest-free payment plans. It’s not uncommon for providers to accept as little as 25 to 50 cents on the dollar of what you owe.”

Don’t be Reluctant to Ask for Financial Aid or Charity Assistance

In a similar way, besides asking for a reduced bill, be honest about your finances. “If you are unable to manage a large medical bill, be candid with the medical provider,” Lazarony writes. “Assistance may be available.”

She spoke with Mississippi financial planner Jay Zigmont who urged those in debt to be assertive in seeking help. “If you have a large medical bill to a hospital, be sure to reach out to their financial aid office or charity care program,” Zigmont told Lazarony. “Most nonprofit hospitals have a program to forgive medical debt if you meet their requirements. They may also offer you a payment plan.”

Zigmont relates how one client with a six-figure debt to a hospital ended up on a payment plan of $20 per month, indefinitely. “It sounds silly,” he says, “but it happens.”

Seek Help from Advocacy Groups to Address Medical Debt

When seeking help with overwhelming medical debt, Lazarony writes, don’t overlook various advocacy organizations in your community. You may also find guidance through government agencies such as Medicaid.

“There are several organizations such as RIP Medical Debt, HealthWell Foundation and the Patient Advocate Foundation that work with individuals to help pay off medical debts,” says author Khalfani-Cox. “Also, if you qualify for Medicaid, you may be eligible to have retroactive medical bills covered. It’s worth exploring these options if you have a disease that’s left you struggling with medical debt.”

By the way, we note that Washington State, home to AgingOptions and Life Point Law, offers this helpful website to guide those dealing with burdensome medical debt.

Credit Tip: Medical Debts Below $500 Don’t Affect Credit Report

Lazarony’s final point isn’t really a suggestion, but it might help bring peace of mind: if you fall behind on smaller medical debts, your credit report will not be affected.

“Medical debt below $500 that is in collections will no longer be reported on your credit report,” Lazarony writes. “So if you slip up on paying a small medical bill and it goes to collection, you don’t have to worry about it hurting your credit rating.”

Author Khalfani-Cox explains that this is a relatively new ruling. “Fortunately,” she told Lazarony, “medical debt below the $500 threshold doesn’t hurt your credit rating anymore. Since the first half of 2023, the three major credit reporting agencies, Equifax, Experian and TransUnion, no longer include medical debt in collections under $500 on credit reports.”

She calls the change “part of a broader shift in how these agencies are handling medical debt reporting.” Khalfani-Cox ads, “[The credit bureaus] also no longer include paid medical debts on credit reports since July 1, 2022, and they’ve increased the period before medical debt in collections appears on your credit reports from six months to one year.”

Breaking News: Rajiv’s New Book is Here!

We have big news! The long-awaited book by Rajiv Nagaich, called Your Retirement: Dream or Disaster, has been released and is now available to the public. As a friend of AgingOptions, we know you’ll want to get your copy and spread the word.

You’ve heard Rajiv say it repeatedly: 70 percent of retirement plans will fail. If you know someone whose retirement turned into a nightmare when they were forced into a nursing home, went broke paying for care, or became a burden to their families – and you want to make sure it doesn’t happen to you – then this book is must-read.

Through stories, examples, and personal insights, Rajiv takes us along on his journey of expanding awareness about a problem that few are willing to talk about, yet it’s one that results in millions of Americans sleepwalking their way into their worst nightmares about aging. Rajiv lays bare the shortcomings of traditional retirement planning advice, exposes the biases many professionals have about what is best for older adults, and much more.

Rajiv then offers a solution: LifePlanning, his groundbreaking approach to retirement planning. Rajiv explains the essential planning steps and, most importantly, how to develop the framework for these elements to work in concert toward your most deeply held retirement goals.

Your retirement can be the exciting and fulfilling life you’ve always wanted it to be. Start by reading and sharing Rajiv’s important new book. And remember, Age On, everyone!

(originally reported at www.nextavenue.org)